Trends at Y Combinator's S23 Demo Day

tl;dr

Y Combinator (YC) is the world’s most renowned early-stage startup accelerator.

Last week, over 200 startups pitched in front of the media and investors as part of their most recent demo day.

75% of the batch are using AI to some extent and “copilot” was probably the most repeated word throughout the event. Many companies working on legal, sales, and banking copilots.

Developer Tools, Biotech / Healthcare also had a strong presence.

Crypto and Climate Tech were less featured as compared to other most recent batches.

This month, my newsletter is coming out a bit earlier because last week I had the opportunity to watch Y Combinator's Summer 2023 Demo Day. The two-day event featured 212 startups pitching in front of thousands of investors and industry insiders via a live stream. Below, I will share some of the trends and themes I noticed during the event.

About Y Combinator

Y Combinator (YC) is the most renowned startup accelerator in the world. Since 2005, they have invested in over 4,500 startups, out of which 350+ are currently valued at more than $150 million, and 90+ are valued at more than $1 billion (over 5% of YC companies become unicorns). Among the most notable companies that went through the program are Brex, Airbnb, Stripe, Dropbox, and Coinbase.

YC hosts 2 batches of startups per year, meaning they select 2 groups of companies every year to participate in their program, which takes around 3 months each (the first one from January to March and the second one from June to August). During this period, the selected startups have office hours, participate in speaker sessions, and meetups with experts in different business areas, founders of successful startups, investors, executives, and others. Every startup also has its own Group Partner who picks the company, works with them throughout the batch, and supports the founders for the life of their company. Basically, YC helps startups go from an idea to an actual business.

One of YC’s biggest value ads is helping startups attract potential investors to their business. Throughout the program, founders are instructed on how to formulate their pitch and storytelling so it is more appealing to investors. Finally, at the end of every batch, they present this pitch in around 1 minute to thousands of investors during the demo day.

Batch Stats

This marked YC’s 37th batch and the first in over three years that took place 100% in person (except for the demo day). It had over 24,000 applications and 212 startups that were selected and pitched. Out of the selected ones:

75% started with no revenue on day one of YC.

81% had never raised any money.

In terms of industry breakdown:

70% in B2B SaaS / Enterprise

10% in Fintech

10% in Healthcare

6% in Consumer

4% Proptech / Industrials

It is important to note that 159 companies were tagged as using AI to some extent, a staggering 75% of the batch!

The founders’ demographics for the S23 batch were as follows:

16% Asian

2% Black

3% Hispanic or Latino

3% Middle Eastern or North African

6% Multiracial

12% South Asian

29% White

Additionally, 15% of the S23 companies have a woman founder and 10% of the founders are women.

Trends

As mentioned in the stats section, AI had a big presence in this batch, which was something YC acknowledged to be intentional. “Copilots” was probably the word I most frequently heard throughout the pitches, supporting the thesis that few companies are attempting to substitute human work with AI but use the technology to help them do their work more efficiently.

Sales Copilots

Sales seems to be one of the most obvious use cases for generative AI and this batch proves many founders are going after this opportunity. 10 startups were tagged as being in the “sales” field, which includes AI tools for prospecting (pre-sales), converting, and supporting existing customers.

Some companies examples:

Double: background research on sales prospects by searching the web with LLMs.

Surface Labs: AI-powered forms, such as demo requests and contact forms, that drive conversion rates.

Octo: AI support agents to replace outsourcing.

Legal Copilots

Legaltech is a sector that I don’t remember being very present in previous YC batches. It was a bit different this time around, with 6 companies being tagged in the legal space, with solutions that help attorneys and in-house legal teams draft new contracts, negotiate better, and answer legal questions.

Some companies examples:

Solve Intelligence: uses AI to help attorneys write patents.

Pincites: helps in-house legal teams close deals faster with AI for contract negotiation.

Hidden Hand: AI paralegal for contingency law firms.

Banking Copilots

We’ve recently seen Brex and many other digital banks adopt AI in their operations, mostly to expedite customer support requests. In this batch, it seems like many founders are betting on selling similar technologies “as a service” so fintechs don’t have to build them internally.

Some companies examples:

Onnix: AI copilot for bankers and finance teams.

Accend: copilot for KYC manual review for fintechs and banks.

Salient: AI collections for auto lenders.

Developer Tools / AIOps

With all these new AI startups and with more enterprises adopting machine learning models that are core to their strategy, comes the necessity for tools to develop and monitor those models. Monitoring can mean many things when talking about AI, including detecting anomalies, bias, data quality, and basically anything around making sure that the model is working the way it should.

Some companies examples:

Parea: DataDog for LLM applications.

Kobalt Labs: modern data privacy for generative AI.

Shadeform: GPU cloud with no hardware - solving for GPU shortage.

Biotech / Healthcare

Moving away from AI (but not completely), biotech and healthcare always have a strong presence in YC and this batch was no different. While there were a few companies developing new tests that don’t have anything to do with generative AI, we’ve seen this technology present in many of the healthcare companies this batch.

Some companies examples:

Cleancard: making cancer screening as easy as a pregnancy test.

Synaptic: AI-powered training for doctors.

MICSI: higher resolution MRI with faster scan times.

Other Cool Startups

Just to highlight the diversity of companies that go through YC, here are a couple that stood out from the traditional SaaS and AI bunch:

HyLight: small unmanned hydrogen airships for long-range monitoring

ChowCentral: asset-light Chipotle for Africa.

Not so hot

Now that I’ve analyzed what was more prevalent in this batch, I wanted to go over two segments that have lost a bit of attention this time around.

The first one is crypto / web3 startups, which had only 3 startups pitching on demo day. This is probably due to the current crypto downmarket that has regulatory uncertainties as one of its main contributors.

The second one is climate tech, a sector that had quite a few startups in this batch but probably fewer than the other most recent groups. I also didn’t see any innovation among the companies pitching in that segment worth sharing.

Dive Deeper

Meet the YC Summer 2023 Batch by Y Combinator

5 neat AI startups from Y Combinator’s Summer 2023 batch by TechCrunch

Thought of the Month

“Over time, the person who approaches life with an openness to being wrong and a willingness to learn outperforms the person who doesn’t.” - fs.blog.

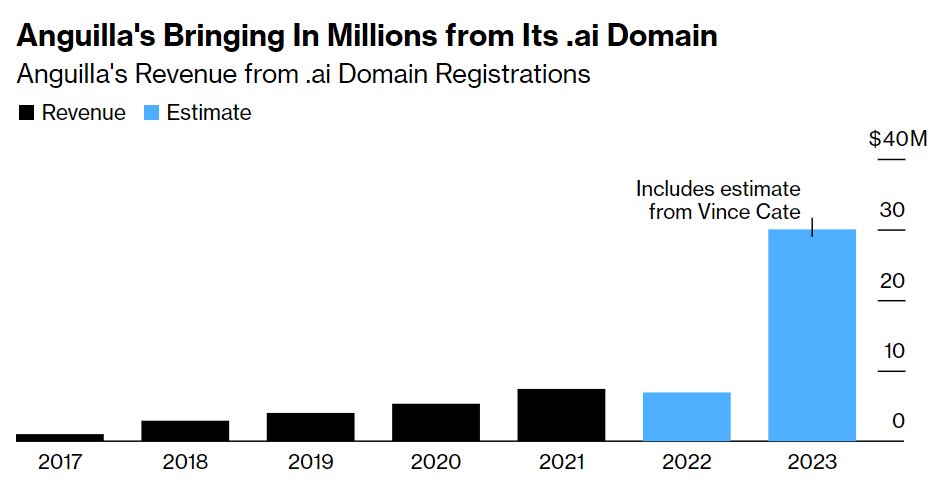

Chart of the Month

The recent AI hype has an unexpected winner - Anguilla. The tropical island in the Carebbean is expected to earn tens of millions of dollars because it has been assigned the .ai domain country code, something that many AI companies are looking to purchase. Luck, I guess?